Egypt, China central banks sign pacts to boost yuan use, payment systems

The central banks of Egypt and China on Tuesday signed three memoranda of understanding aimed at promoting the use of the Chinese yuan and expanding electronic payment cooperation, the Central Bank of Egypt (CBE) said in a statement.

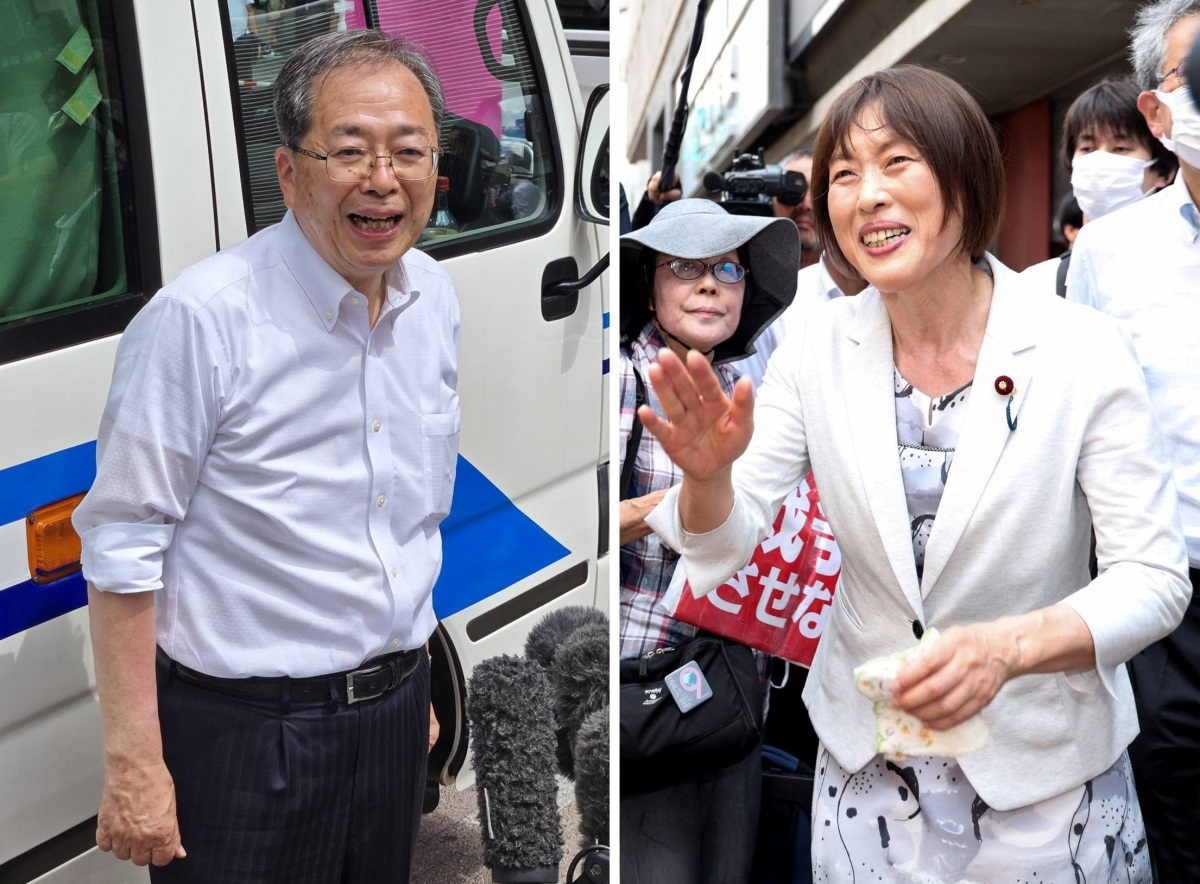

The signings took place after a meeting between CBE Governor Hassan Abdalla and his counterpart from the People’s Bank of China, Pan Gongsheng, at the CBE’s headquarters in Cairo during the Chinese official’s current visit to Egypt.

During the talks, the two officials discussed several key topics, including a currency swap agreement, settling payments in local currencies, Egypt’s issuance of “Panda” bonds in the Chinese market, and linking their respective payment systems, the statement said. They also affirmed the importance of increasing the presence of each other’s banks to encourage joint investment.

One of the agreements was signed between Suez Canal Bank, TEDA China-Africa Investment Co., and CIPS Co. Ltd., the operator of China’s Cross-border Interbank Payment System. It aims to promote and encourage the use of the Chinese yuan within the China-Egypt Trade and Economic Cooperation Zone.

China’s UnionPay signed two protocols. The first, with the Egyptian Banks Company for Technological Advancement (EBC), aims to improve e-payment infrastructure and expand the acceptance of UnionPay cards in the Egyptian market. The second, with fintech firm Paymob, focuses on cooperation in marketing electronic payment acceptance services for UnionPay cardholders.

In the statement, CBE Governor Hassan Abdalla welcomed the visit, saying it was an important opportunity to exchange expertise and expand financial and banking cooperation to support economic stability and sustainable development in both countries.

The agreements underscore the efforts by both countries to enhance their strategic partnership and support economic integration by developing financial infrastructure and expanding cooperation in digital payments, the CBE statement added.

.jpg?width=1200&auto=webp&trim=0,0,0,0#)